This is your TSP Watchdog UPDATE for the week ended February 7, 2020.

Stocks rocketed higher this week – with all three major indexes gaining 3%, or more: S&P 500 +3.17%, Dow +3.00% and NASDAQ +4.04%.

All three indexes posted new all-time highs on Thu before selling off on Fri. At the close on Thu, the Dow had gained more than 1,000 points for the week. Even after a 277 point drop on Fri, the Dow gained 846 points for the week. Looking back over weekly data for the past few years, this was the best week since Dec 2018.

(all market data courtesy of the Wall Street Journal Online edition)

Several factors contributed to the market’s gains: news of possible breakthroughs in treating the coronavirus, solid earnings announcements, a strong jobs report and other economic data points and President Trump’s acquittal in the Senate impeachment hearing.

In fact, investors have never been worried about the impeachment proceedings, and the coronavirus seems to be gaining momentum – as it surpassed the death toll of the SARS virus.

Friday’s selloff was probably more a profit taking episode after such a strong week. But, going forward, the economic impact of the coronavirus could become a bigger factor. At the least, investors may be cautious if the impact of the virus expands.

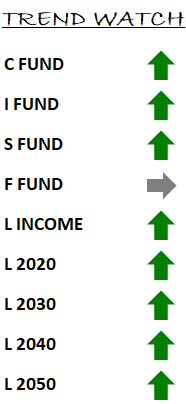

In our TSP Watchdog database, strong price gains strengthened the positive trends of the C fund, S fund, I fund and all the L funds. We continue to hold the C, S and I funds in our allocation models.

Only the F fund remains on a negative trend – despite a recent run-up.

We have received several inquiries about how long we think the market will continue to rally. In fact, we have no idea. What we do believe is that when the market finally turns down meaningfully, it will reverse to a negative trend before it falls too far. If we adhere to our process and step aside when the trends turn negative, we may be able to avoid the worst of the damage – preserving capital so we have more to participate in the eventual recovery.

We don’t know when the trends will change – so we are happy to ride the current positive trends as long as they persist. We hope, and expect, that our trend following analysis can help you remain invested and participating in the market’s gains rather than being scared out of the market by dramatic headlines.

We’ve had several news stories in recent months that could have scared investors out of the market: the trade war with China, a Presidential impeachment, the Coronavirus, etc. By following our trend analysis, we have been able to advise you to stay the course and remain invested even if the headlines were unnerving. Over the past year, this has been profitable advice.

No one knows how high this market will go, but as long as the trends are positive, we will advise you stay invested.

And, we are here to answer your questions. Feel free to send them over as a reply to this email.

Scot B.