This is your TSP Watchdog UPDATE for the week ended March 20, 2020.

I want to preface my comments this week by acknowledging that many of you may have much more pressing and important things to think about than the stock market.

That said, TSP Watchdog is intended to assist you with the management of your TSP account. Regardless of how difficult the times are, you have requested our input, and we will continue to give you the best ideas we have – about the stock market – with respect for the fact that you may have bigger fish to fry right now.

You probably already know – stocks fell sharply this week. The S&P 500 lost 14.98%. The Dow fell 17.30%. The NASDAQ slid 12.64%. It was the worst week for stocks since 2008.

From their recent highs (last month), all three indexes are off their highs by 30% or more:

S&P 500 -32%

Dow -35%

NASDAQ -30%

(all market data courtesy of the Wall Street Journal Online Edition)

There is no candy-coating things. We are facing the worst possible scenario for stock prices: there are big problems afoot and uncertainty at every turn. Remember, the market hates uncertainty even more than it hates problems.

For my entire career (35 years and counting) a common mindset around the investment world has been “never bet against the American consumer”. Time and time again, the American economy has climbed out of holes on the back of consumer spending. Today, efforts to stop the spread of the coronavirus have bottled up the American consumer in an unprecedented way.

At the risk of piling on, but with the intent of giving objective information, it is likely that recovering from the current situation will not be as simple, or as quick, as just allowing people to go back out in public. The fallout from the slowdown may put many businesses out of business – requiring a reshuffling of the deck before the economy can get back on its feet. But, it will come back.

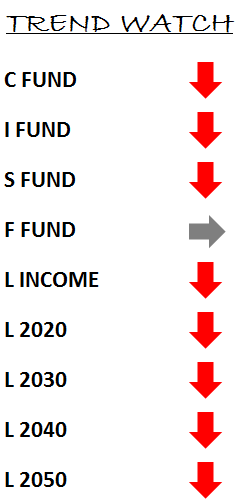

In our TSP Watchdog database, the trends remain negative. We are VERY GRATEFUL to have recommended three weeks ago that 100% of your holdings be moved to the G Fund. At the time we made this recommendation, the C Fund was DOWN 8.69% from its recent all-time highs; the S Fund was DOWN 10.52% from its highs; the I Fund was DOWN 9.78% from its highs. Since then, the C Fund is down another 25.34%; the S Fund is down 33.94%, and the I Fund is down 25.11%.

(all TSP data obtained from www.tsp.gov)

If you followed our trend analysis, you have sidestepped approximately two-thirds of the decline – and you do not need to worry about the continuing volatility.

If you did NOT get out of these funds, you have a few choices:

- You can just ride things out. This could be painful. It will almost certainly be a bumpy ride.

- You can jump out now. While it may seem too late to sell now, if there is further damage – more selling and more losses – you could avoid whatever harm is still to come.

The risk to selling now is that the market bottoms out soon, and you end up “selling at the bottom”.

One question you can ask yourself to help decide your path is “which scenario would be more upsetting: staying invested and riding the market down another 10%, 20%, 30%, or more?Or, selling now, and missing out on the first 10%, 20%, 30% or more of any ensuing recovery, if the market does, in fact, rally shortly after you sell?”

If staying invested and riding the market down further worries you more, then you might be best off to sell now – at least partially (see Option #3 below).

If missing part of a recovery concerns you more, then staying invested may be more appropriate for you.

- You can sell part of your holdings now and hold on to the rest. This approach hedges you – as you reduce your exposure to future declines but also keep at least a toe in the water to participate in a possible recovery.

This approach can also be executed with multiple sales at roughly equal intervals – kind of a dollar-cost-averaging OUT of the market.

There is no right answer to how you should proceed if you still have some money in the market. You are playing defense and trying to minimize damages at this point – or just riding things out and hoping for a quick recovery.

We have been swamped with inquiries in recent weeks. We are trying our best to respond, but it is taking longer than usual. Please understand.

…and please look for small, unacknowledged ways to help your fellow Americans…of all political persuasions.

Scot B.