This is your TSP Watchdog UPDATE for the week ended March 29, 2019.

Stocks returned to the PLUS column this week – with the S&P 500 gaining 1.20%, the Dow gaining 1.67% and the NASDAQ gaining 1.13% (based on market data published in the Wall Street Journal online edition).

These gains capped a VERY strong Q1. Here are a handful of datapoints I found on the S&P Dow Jones Indices website:

- It was the best first quarter since 1998 – all the way back in the dot-com days when the S&P was in the midst of five consecutive years of 20%+ gains (1995 – 1999, inclusive).

- For the S&P 500, it was best quarter since Q3 2009 – at the very beginning of the recovery from the Great Recession.

- For the Dow, it was the best quarter since 2013.

To be candid, I cannot put my finger on why investors are so bullish. Corporate earnings announcements for Q1 will begin in mid-April, and, on average, expectations are for negative comparisons! But that seems to be baked into the current rally. Concerns about slowing global economic growth also seem to be factored into the recent rally. And, while trade talks with China appear to be progressing, there is still no agreement – and certainly no assurance that an agreement will be reached.

On the flip side, interest rates have come down slightly, and it does not appear that the Fed will be raising rates anytime soon.

And, of course, there was the submission of the Mueller report – which showed no collusion with Russia and suggested that without collusion there really wasn’t a case for obstruction of justice. Perhaps, investors are hoping that removing this cloud from the landscape will make the world a happier place. My guess is that the biggest result will be a wholesale reversal of opinions about the Mueller investigation – with Republicans now hailing the report while Democrats run it down – quite a reversal.

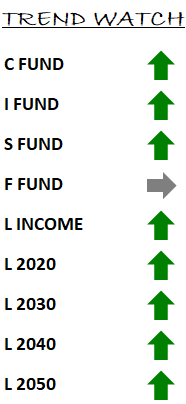

In our TSP Watchdog database, we have no trend changes to report – and, thus, no changes to recommend in our model allocations or TSP accounts, in general:

- The C fund, S fund and I fund remain on positive trends – meaning we view them positively, hold them in our model allocations and are comfortable with TSP participants holding them in their accounts.

- The F fund continues on a negative trend (barely) – meaning we view it negatively, do NOT hold it in our model allocations and do not feel it is prudent for TSP participants to hold it in their accounts.

If you began a systematic process of moving back into the C fund, S fund and/or I fund when their trends turned positive again several weeks ago, you can continue to add to these positions as long as their trends remain positive.

When the market rises with no easily identifiable, clear reason for its advance – it feels more and more like climbing out on a branch the further prices rise. We certainly do not want you to go into free fall if that branch breaks. We will alert you if/when trends change (the branch breaks). Our process is intended to provide alerts before the ground breaks your fall – to preserve capital so you have more to participate in the ensuing market recovery.

Our process is also intended to encourage you to stay invested as long as the trends are positive – to avoid being scared out of the market by news that, ultimately, does not have the impact on prices that you expected, and to dissuade you from making changes based on hunches, or guesses about what the market might do.

Until trends change, we recommend staying the course.

As always, feel encouraged to reply to this email with any questions.

Scot B.