This is your TSP Watchdog UPDATE for the week ended July 19, 2019.

Stocks were down this week. After hitting new all-time highs on Mon, all three indexes sold off moderately: the S&P 500 lost 1.23% for the week; the Dow dropped 0.65%; the NASDAQ slid 1.18%.

There was no dramatic news that prompted the selling. It was more a “take a breather” round of selling.

Actually, the economic news during the week was solid – though not spectacular. Retail sales reports were better than expected (representing the largest segment of our economy), while manufacturing results were in line with expectations.

There is also progress on the budget and debt ceiling negotiations in Congress – though no final deal yet.

On the other side of the scale, global uncertainties continue to weigh on investors. The trade war with China continues – with no active negotiations under way. This week, there were telephone conversations between the countries, but at this time, there are still no in-person meetings scheduled.

Interestingly, public opinion about the trade war with China may be softening – even gaining support. It is difficult to tell whether this is an actual shift in public opinion or the result of attention shifting to the field of 2020 Democrats and/or “the Squad” of four freshman female House representatives. Some folks might describe recent tweetstorms as, among other things, “cover fire” for the trade war. Hmmm.

Finally, in the Q2 earnings report from Microsoft (“MSFT”), there were interesting details about the company’s focus shift from its Windows operating system software to cloud services. Bill Gates has admitted that his biggest mistake was being late to the game on cloud computing. Now MSFT is playing catch-up – but the results seem to be good. This latest quarterly report shows MSFT second in cloud computing only to Amazon, with Google decidedly third. It is impressive what a giant can do when it puts its mind to it.

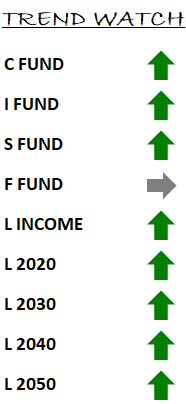

In our TSP Watchdog database, there are no trend changes to report. The mild decline this week was not enough to reverse any positive trends – especially in the wake of several weeks of new all-time highs.

This means we continue to hold all three growth funds – C fund, S fund and I fund – as well as all the L funds (which hold heavy positions of C, S and I).

Only the F fund is on a negative trend – one which has persisted for several months – remaining just below its trend line.

We continue to get inquiries about holding funds that are at all-time highs – is the risk getting too high? All-time highs are a funny thing – a two-edged sword, if you will. On the one edge, the downside from all-time highs seems greater. It can have the feel of looking over a cliff – nerve-wracking. On the other edge, long term market moves include a progression of new all-time highs. Since 1985, when I started in the investment industry, the Dow Jones’ move from 1250 to 27,000 has included, literally, thousands of new all-time highs. Fretting over each new all-time high would not have been a good approach.

As with so many things in life, the “truth” lies somewhere in the middle. Our “middle” is a trend analysis process that is designed to alert us when market moves are significant enough to warrant attention. So, we will continue to ride the current parade of new all-time highs until a downturn is significant enough to reverse the current positive trends – and we will certainly alert you if/when this happens.

In the meantime, realize that it is very rare for a market to rise, rise, rise – and then fall immediately from its highs. In the overwhelming majority of instances, markets peak – and then roll over gradually before they accelerate down. Historically, our process sees trend changes before markets accelerate down very far. This is not a guarantee, but it is an identifiable pattern.

As always, please fee encouraged to reply to this email with any questions. We are here to help any way we can.

Scot B.