This is your TSP Watchdog UPDATE for the week ended October 4, 2019.

Stocks fell for the third week in a row – albeit modestly. The S&P 500 was off 0.33%. The Dow was down 0.92%. The NASDAQ actually gained 0.54% – due in no small measure to the rise in Apple shares, on news that demand for the new iPhones is stronger than previously reported. (all market data sourced from Yahoo! Finance)

Figuring out what the causes for the market’s moves is getting harder and harder – as all the headlines are focused on House impeachment efforts and positioning, and it is taking more and more effort to sift through all the “noise”. Wall Street still views impeachment as a long shot.

What did catch the Street’s attention this week was very weak manufacturing data reported early in the week and then a “Goldilocks” employment report at the end of the week – not too good but not too bad, either. Stocks recovered most of their early-week losses on Fri after the employment report came out.

Trade and earnings will take center stage this week – with trade talks between China and the US resuming and Q3 earnings season kicking off. Expectations are muted for both.

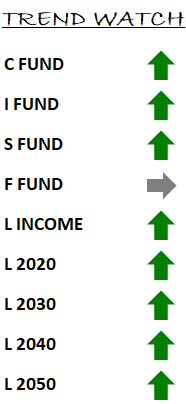

In our TSP Watchdog database, we still have no trend changes to report. The C fund, S fund and I fund remain on positive trends while the F fund continues on a negative trend. As we’ve seen for a few months now, this means that we continue to hold the C, S and I funds in our model allocations while avoiding the F fund.

When the market is in a range, or declining gradually, we seldom see trend changes. If a decline persists long enough, we will see trends turn down – but we have not seen that yet.

For now, we will maintain the status quo. But there are plenty of news stories that could rock the boat and cause trends to change – so we are watching closely. As soon as we see trends shift, we will alert you so you can take appropriate action.

Please feel encouraged to reply to this email with any questions.

Scot B.