This is your TSP Watchdog UPDATE for the week ended November 22, 2019.

Stocks finally paused to catch their breath this week. All three indexes retreated modestly – with the S&P 500 losing 0.33%, the Dow slipping 0.46% and the NASDAQ declining 0.25%. These losses ended winning streaks of six weeks, four weeks and seven weeks, respectively. (all market data courtesy of Yahoo! Finance)

These modest changes in the indexes seem in line with a non-descript week of financial news. There just wasn’t a lot happening on Wall Street. It is questionable whether even major financial news would have cracked the news cycle hyper-focused on the impeachment hearings.

On the topic of impeachment, Wall Street continued its collective yawn. Market activity is, arguably, the best gauge (polling mechanism) out there, and it is saying impeachment is a non-issue. You can, literally, take that to the bank.

Trade talks with China continue – though no concrete progress has emerged. There have been pronouncements, but no agreements. The longer we go without an actual agreement, the more worried investors become that no deal will happen.

Our friends at StocksandNews.com report that corporate executives around the world are noting that both hiring and investment decisions have been postponed until the trade picture becomes clearer. Not good – these are the building blocks of economic growth.

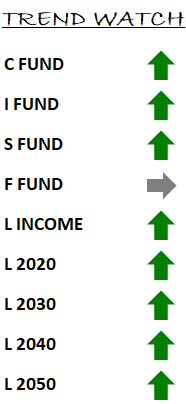

In our TSP Watchdog database, we have no trend changes to report. This is no surprise – as a modest, single-week decline is not enough to reverse the trend created by weeks and weeks of larger gains. But, one never knows if a current micro-decline may be the first step in a sequence that does reverse trends. We are watching.

The C fund, S fund and I fund remain on positive trends. This means we include them in our model allocations – essentially giving these funds a “thumbs up”.

The F fund remains on a negative trend. It has gained moderately – coming in closer to a “neutral” trend – but not enough to register as a “positive” trend. This means we do not include it in our allocation models. The dollars we would hold in the F fund, we instead suggest holding in the G fund until the F fund returns to a positive trend.

We receive questions about allocating these F fund dollars to the C, S and I funds rather than the G fund – since they are on positive trends. While this is not how our process is designed, it is certainly a reasonable approach – albeit, a more aggressive one. If you prefer to reallocate to funds that are on positive trends, we do not object – it just isn’t how our model works. Of course, you are the ultimate decisionmaker for your TSP account; you can make the choice as you see fit. The most important thing is to avoid funds that are on negative trends while concentrating your holdings in funds that are on positive trends.

Have a wonderful Thanksgiving! Do take the time to count your blessings.

Scot B.